DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

This Time It's A Wave Three, Episode 10

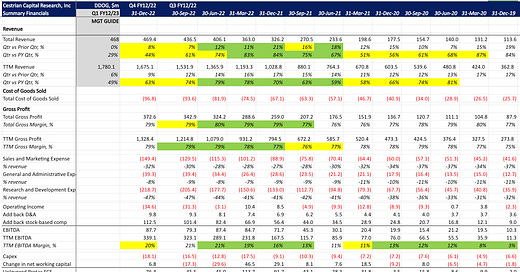

DataDog (DDOG) reported its Q4 earlier this month. Midpoint of the guide for Q4 was revenue of $447m; they beat that by a little under 5%. You can see the full set of numbers below.

In short, another ho-hum kind of quarter much as we have seen from most other tech names. The stock has sold off a little since the print - generally speaking we have seen big moves up in tech off the back of average or even bad numbers - here we have the stock continuing in the sideways range it has held for some time now.

As far as tech earnings season has gone so far - and there’s a wall of companies due to report today after the bell too - the reason for the moonage or dumpage in each stock's case is not at all related to the earnings in our view. It's to do with whether Big Money has had enough time to buy enough of these names to get their desired do-over for missing out on them all during the Covid crisis boom time, when no-name stocks like this one were enjoyed mainly by degenerate former Chads now running levered beta hedge funds. Oh and also by Chads. Boomer Money declared humbug and left them alone. Wrongly as it turned out.

Now having swung the J P Morgan Collar Trade Wrecking Ball at high beta stocks all through 2022, here we are at the Big Money induced Wave Two lows.

And lo and behold here in the volume profile is Boomer Money buying up these apparently trashcos (check FinTwit! - 2023 boom = Dash for Trash ... more neurolinguistic programming to ignore) in anticipation of Late Money aka Chad Partners Fund II, LP, coming to chase the stocks up once more.

But not yet, in DDOG's case.

For our Premium and Pro member we take a look at the DDOG earnings print and the resulting stock reaction. We lay out our price targets, accumulation zone ideas, and risk management ideas. If you’re not yet a Premium or Pro member, you can sign up right from the button below.