DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Think Different.

If you like us are older than 12, and can remember when you weren’t behind the times, you probably think of Marvell as a semiconductor stalwart that had a more or less monopoly on hard disk drive controllers back when that mattered. This is pretty much how we think of the stock, though it has come a long way since then. Let’s call it a journeyman semiconductor company whose stock has been beaten down with the sector but has been looking likely to move up as fundamentals improve and money gets a little more available and less expensive. Simples. In staff personal accounts we have been quietly buying modest allocations of MRVL 0.00%↑ with this in mind.

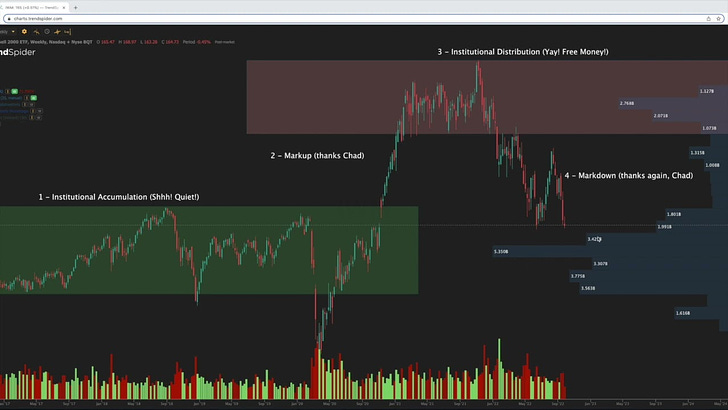

Usual Wyckoff Cycle stuff. Not so exciting but often effective.

Oh - we include a video about using the Wyckoff Cycle, here.

(Don’t forget to subscribe to our YouTube channel for more of this stuff by the way).

It turns out, though, that Marvell is in fact a pureplay AI name. For how else can you explain the moonage in the stock price yesterday after they printed earnings?

It’s easy to understand the cray-cray move in NVDA 0.00%↑ after their print. Telling the market that you’re going to deliver $11bn in revenue next quarter - a +64% growth rate - will do that. Especially when this quarter you printed +29% TTM unlevered pretax free cashflow margins. (Yes, bears, they did. Deal with it).

But to get into the market’s mindset and win with boring ole Marvell, you need to think different. (We’re talking to you, gramps).

Well, let’s take a look.