DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

How To Get Ahead

Here's what the majority of investors are doing now.

Cohort One - is cursing Jerome Powell, Bill Ackman, Jim Cramer, The Motley Fool, everyone on CNBC and everyone in the Wall Street Journal, in fact EVERYONE, and only latterly themselves, for missing the huge run-up in growth stocks in the first half of 2023. These folks are now starting to buy back into the market, and hate themselves for not doing so earlier. Or they are net-shorting the market and/or Nvidia because "it must" come back down again because recession and blahzzzzzzzzzzzzzzz.

Cohort Two - caught the move up and is sitting on YUGE paper gains and thinks the move up in 2023 to date will continue apace. These folks are congratulating their own brilliance and planning what they are going to buy when their calls go TO THE MOON as 2023 plays out to be a better year for stonks than was 2020.

We have news. Both these cohorts, and they are large cohorts, are likely to get tripped up by the small number of investors who move huge amounts of money and go by the name of Big Money (in our world) or the Consolidated Operator (in the Wyckoffian theme).

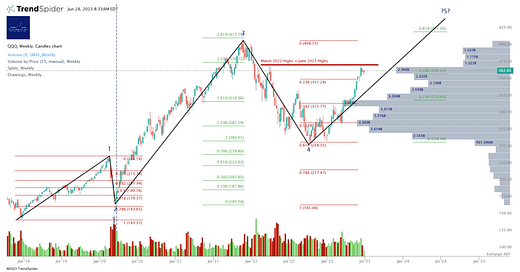

Big Money is sailing toward Q2 quarter end - that's Friday this week - which is important in two regards. First, if you are a long-only manager, you want your paper valuations to be high, so that you can declare yourself a true Master of the Universe to your clients, colleagues, line manager, back office staff, canteen staff, the guy who washes your car for you, and in fact everyone to whom you speak next time you're at the airport. Second, from 1 July, you need to be very, very clear what your game is towards year end, lest you mess up on performance fees, the very essence of the Hamptons way of life. Do you continue to hold growth stocks in the hope that they continue to move up through the Markup Zone and make new all time highs, compounding your current paper gains in these names and generating enough IRL money to buy the new motor yacht, the good one, the one that Bill down the street definitely can't afford? Or do you cash your gains and re-invest them into stocks which themselves are under accumulation right now, which you might find in financials, utilities, even, shudder, real estate?

The choice that Big Money makes here is very material if you own growth stocks at present. A lot of these names are maybe halfway up our Markup Zone. We believe that in time they can make new all time highs and go on to hit our Distribution Zones. But they probably won't go straight up to get there. Probably there is going to be some profit taking. And you - only you, it's specific to your financial, psychological and emotional setup - need to decide, do you take your money, and roll it back into deep-accumulation-zone names? Or do you hold on for dear life and hope the growth stuff continues to moon?

If you have a moment, read our public note on MongoDB yesterday as a great example of this. You can find it here:

We Banked The Free Money From MongoDB (NASDAQ:MDB)

Read also our recent note on Palo Alto Networks - here:

Palo Alto Networks (PANW) Stock: Time To Take Profits

So, should you sell? We discuss below for our Premium and Pro members here at Cestrian Tech Select.