DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Unstoppable Save For Invasion

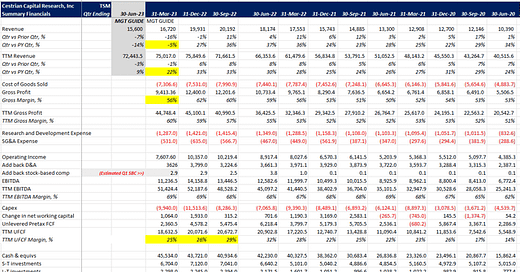

For as long as China doesn't look to be actually invading Taiwan, we believe TSMC can be owned for the long term. It is almost a monopoly in the fabrication of advanced semiconductor devices, and if you're wondering what can keep its moat in pace, $36bn of trailing twelve month capital expenditure goes a long way to answering that. Furthermore, chip production is nasty, brutish and difficult and chip designers - meaning fabless companies like Nvidia et al - don't like to switch providers lightly.

For our Premium and Pro members, we run through the numbers, valuation and stock price outlook. If you’d like to receive these earnings reports, our Premium membership gets you access. Pro gets you 24/7 access to our library of earnings reports, current tech stock ratings, stock charts, and weekly live webinar with senior Cestrian staff.