Tesla Q1.

Tweet of the day: "Tesla begins the long slide to becoming Stellantis' premium EV brand".

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Reality Distortion Field Jammer Set To “On”

Where TSLA 0.00%↑ is concerned we’ve always found that the best way to analyze the company and its stock is … to do so using the same methods as any other company whose stock we cover. Save for the occasional mid-earnings-call pop or dump we find it best to ignore Musk completely (our appetite for drama and hoopla is low) and focus on the numbers and the stock chart.

You can read in about a thousand other places all the stuff about wanting to sell cars for zero profit but then make money from full-self-serving-driving software updates, and you can form your own view on the jam-tomorrow theory of value creation. We won’t rehash that stuff here.

Here we’ll just post the numbers as we see them and give our chart outlook too.

Numbers

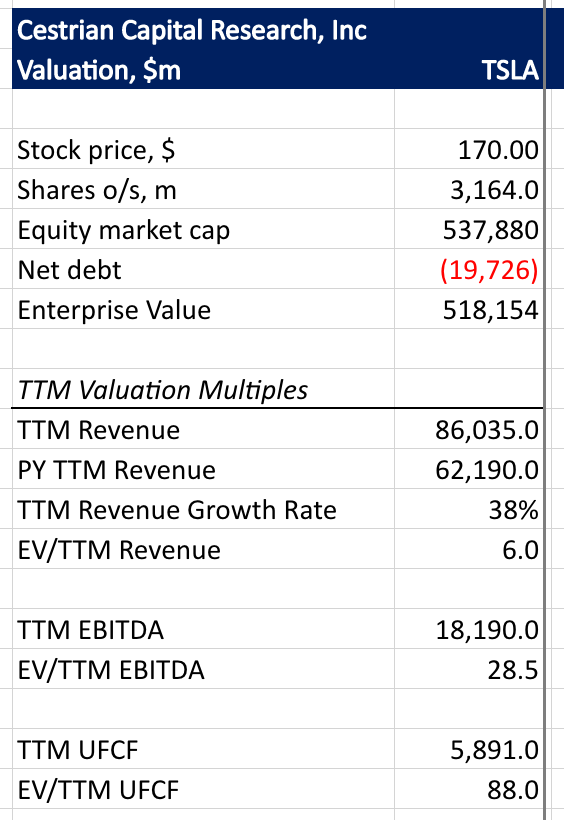

Revenue growth slowed once more, to +24% this quarter vs. the same quarter last year, bringing TTM revenue growth to +38% YoY.

Gross margins fell to 19% with no split-out at present for the automotive gross margin - this is the effect of the serial price cuts.

EBITDA margins remain fine on TTM basis at 21%

But TTM unlevered pretax FCF is now down to 7% margin, dropping fast (it was twice that only two quarters ago, and TTM measures don’t usually change that quickly).

Balance sheet remains strong with just shy of $20bn net cash.

This means TSLA’s fundamental valuation stands as follows:

If growth or cashflow margins or both were going in the right direction, there’s nothing too painful about those multiples; but paying 6x TTM revenue for a 24% growth, 7% cashflow margin business is quite rich.

How about the stock chart? Short term we think there’s risk down to $125. It’s possible that Tesla is now a busted flush - but it’s also possible that Musk gets focused, hires a CEO for either Twitter or Tesla or both, and the company starts executing properly again. For now in staff personal accounts we’re short Tesla (we were short going into earnings having been previously long) and we’ll see for how long that proves wise. Generally speaking shorting TSLA has been a mug’s game so we’re likely to take gains if and when they become available rather than holding on for the heroic outcome.

The chart below (click HERE to open a full page version) just illustrates what a local Wave 2 down could look like - in essence up to a .786 retrace of the Jan-Feb move up. That can still work out bullish long term if we then see a new Wave 3 develop and hit the highs.

We rated the stock at Distribute going into earnings. We may move that back to Hold depending on the stock’s reaction in the coming days.

Video Analysis Of Tesla Earnings

We discussed TSLA and NFLX on our Pro-tier webinar today. Pro members can watch the recording below. If you’d like to gain 24/7 access to all our tech stock ratings, stock charts, and staff personal account positioning, you can step up to a Pro membership at the link below.