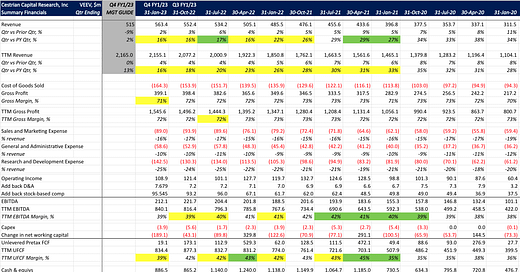

Veeva Systems Q4 FY1/23 Earnings Review

A solid quarter and the stock is responding in kind. Read on!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

You At The Back! Stay Awake!

Vertical market enterprise software companies are no-one’s idea of exciting. First of all, for the most part nobody has heard of them. Secondly, they come with no bragging rights if you make big on the stock, and there’s no group commiseration if you mess up on the stock. It is a lonely and boring part of the market in which to invest.

Which is precisely the appeal, of course. Recurring revenue aplenty, high margins arising from limited competition, and rock-solid cashflow as a result of being able to charge customers upfront. These are the reasons to hold vertical market plays.

Veeva Systems VEEV 0.00%↑ - the leading provider of vertical market application software to the life sciences industry - delivered a rock solid quarter last week. The stock flip-flopped in the immediate aftermath of earnings, before Everyone Decided It Should Go Up, whereupon it went up.

Premium and Pro members, read on to see our review of financial fundamentals, our technical analysis of the stock, and our projected stock prices going forward.

If you’re a free user here and you’d like to step up to Premium or Pro membership, you can do so right from this button.